Reconciliations

Reconciliations

Financial Institutions, in their overall functions and operability, manage a vast amount of data flows of various nature, form and often conspicuous volume, that come from: different management platforms, various internal sub-systems and external subjects (e.g.: Custodians, Clearing Houses, Banks).

Over the years, therefore, series after series of multiple tools, in some cases automated, have been designed, all aimed at solving specific reconciliation and exception management tasks, without taking a holistic vision of the risks.

Easy Match: the CAD IT’s value proposition

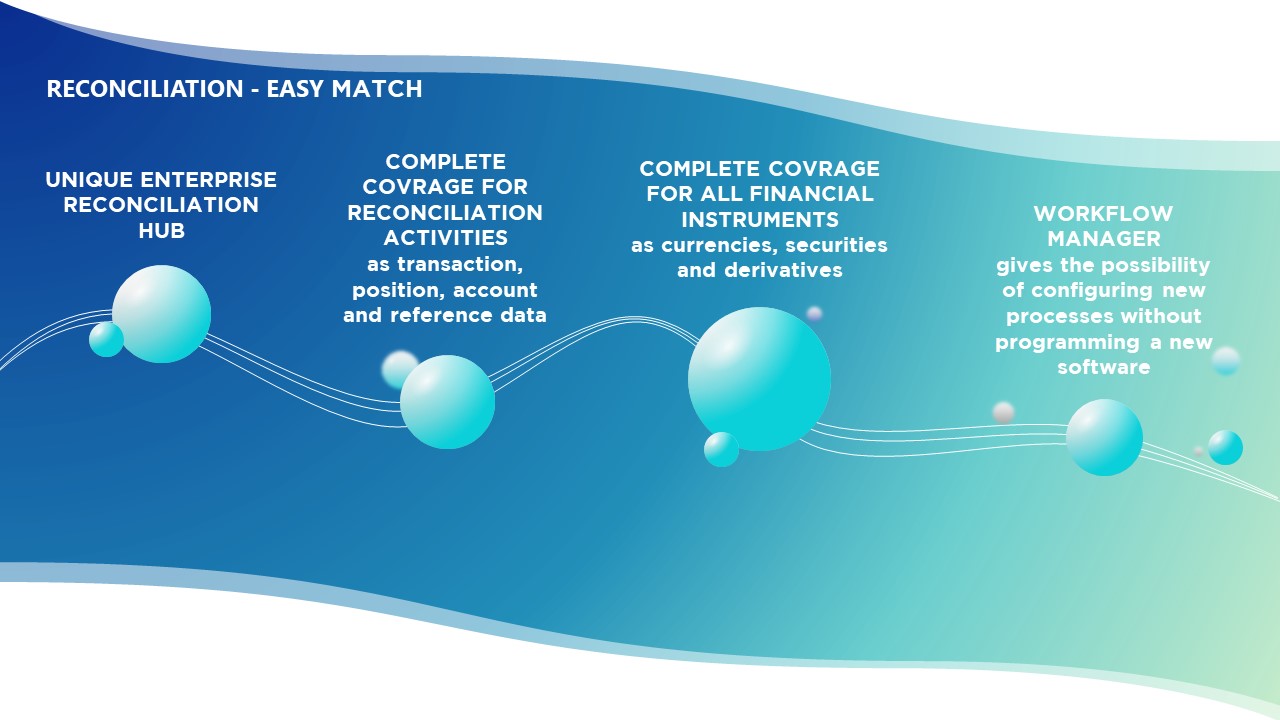

Easy Match is a unique enterprise reconciliation hub that deals with a full range of reconciliation activities including: Transaction, Position, Account and Reference Data. It covers all instruments including currencies, securities, commodities, derivatives, and it manages all types of accounts including balance sheet and suspense.

Easy Match, with its workflow manager tool, provides you with total independence in extending the reconciliation scope and offers you the possibility of configuring new reconciliation processes.

Easy Match is designed around the experience of large international banks that wanted to substitute their various reconciliation and investigation packages with a new generation tool in order to benefit from the new opportunities that developments in modern databases, business intelligence tools and data analysis tools are providing, as well as one that would be able to manage millions of items in a matter of minutes.

Salient features

Easy Match offers:

- an intuitive interface for data definition at load time, including fully customisable data mapping, enrichment and data masking;

- a configurable validation of data import with secure error recycle processes;

- the ability to define and progressively develop complex (incl. layered, conditional) matching logic;

- a case management incorporating automated alerting and escalation, with the ability to apply /re-apply manual matches within a secure audit trail;

- precise reporting and clear presentation including dashboards and drill-downs delivered in multi-channel;

- the flexibility to define workflows, authorisation limits and exception management paths.

italiano

italiano english

english español

español